Holding Stocks and What to Do While They Incubate

SPONSOR:

The trend is your friend! Click here to see the Top 50 Trending Stocks.

What happens during incubation? As I mentioned, it’s like planting a seed with the intention of watching it grow. Whether you’re a short- or long-term stock holder, stock positions are taken using your money and they must be monitored. To think that after buying a stock you’re done participating in the investment is a mistake.

Buy it and forget about it is not a good incubation! That’s actually the buy and ignore strategy.

What you’ll be doing during this time is monitoring your investment portfolio for gains, losses and price laggards. While you’re monitoring the positions, there will be times that stock prices will go against you and for this reason, Stock Trading Warrior recommends having

stop losses

on every position unless you’re willing to sit in front of your computer all day watching your positions.

Other wise, if you don’t have stops on, it’s possible you’ll look at your portfolio and there might be a loss that starts to make you feel uncomfortable. Or, it could be a large gain that gets emotions stirred up and makes you unsure of what to do with it. As soon as that happens, the brain goes into fear mode. Most people either try to deny their fear or they let it consume them and waste emotional energy.

The way to alleviate fear is to have a plan for the three main outcomes of stock holdings.

Gains

For gains, a trail stop is great because it puts your stock holdings on autopilot and allows you to capture gains. You can keep an Excel spreadsheet of your active trades to help you monitor price activity. I always know what the active gain or loss is on any position is if I were to sell the stock today at the current price (Today's Percent Gain/Loss).

More recently, I've added the stock’s price high and what the trail stops gain/loss percentage would be if the price dropped (“Real” Percent Gain/Loss). This gives me worst case scenario on what the gain or loss would be if the price just tanked. This way I always know how much my portfolio gain would be if prices hit the trail stops. I let the stocks with gains do their thing and enjoy updating the spreadsheet with the stocks at new price highs.

It’s easy to over think a gain with the intention to capture more of it, but the problem is that a stock price is influenced by so many things. As a retail stock investor, I realize that I won’t be able to know as much about a stock that there is to know. However, I know I don’t have to be the most knowledgeable person in the room about a stock, but I can be the most content and confident one and that’s the psychological position I want to come from and I hope you do too.

A trail stop will capture a gain on a stock that has trended and that's what we're here to do in stock trading.

It’s also the case that if a stock has a really good gain, you may decide to take some discretionary profits. Some investors take partial profits in a stock holding to off set risk and let the remaining position run.

Losses

The initial

stop loss

on any stock will eliminate it from your portfolio if the trade goes bad and put the money back into your portfolio to invest elsewhere. A loss is an anticipated and acceptable outcome. After putting as many viable probabilities on our side and a price move fails – selling is always a good thing and should be looked at positively.

A commission fee is a small insurance policy to protect you from losing too much capital. Remember that if a company is so great it may be that the price will rise again and you can get back into a position if the price begins to perform for a second time. There is a false hope that has been instilled in investors using the buy and hold strategy that the price will always come back.

This isn’t always true. Look at a chart of Research in Motion (RIMM). It has to be a value at $11.26. Right?!

Laggards

A "laggard" is a non-performing stock. You’ll notice as you monitor your portfolio that some stocks just hover in a price range and don’t trend. It’s true that these stocks may eventually pop up, but time is still a factor in investing. If you have to wait six months for a stock's price to pop for a marginal gain – that’s six months of wasted time in my book. It’s preferable to have placed money in positions that are trending and earning gains and dividends (if applicable).

For example, take a look at a chart of Procter & Gamble Co. (PG) below. The price of the stock is a little less than it was a year ago. That's a laggard. If a whole year goes by and you haven't earned a gain or worse, you've lost money (while including the dividend) - that's a waste of time.

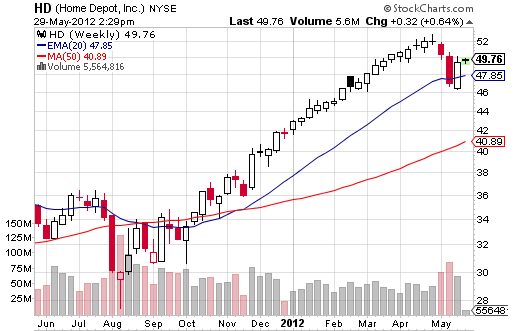

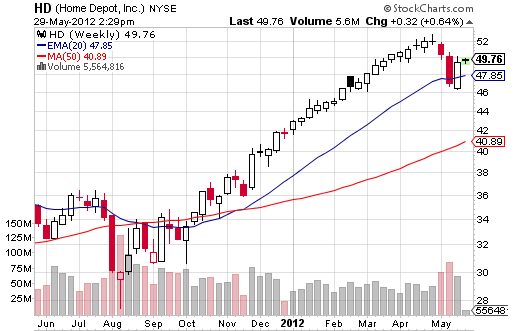

Looking at a comparison of PG and HD (chart below), which stock would you rather have held for the last year? Both paid dividends, but one was also a gainer.

If a stock position in your portfolio has been ranging for an extended time and you have no strong reason to believe something will change, sell it and look for a better stock. You can tighten up a trail stop while you look for a new, more promising stock position. This is efficient and aware investing that keeps your capital earning you gains.

There’s a positive aspect of awareness of all three of these scenarios. No matter what happens during “incubation” you can be sure you’re investing effectively and feel empowered around your investing action because you know what to do in any case. That confidence will go a long way to making your investing experience an enjoyable and pleasant experience.

ACTION STEP: Add to your

trading plan

the action steps for the three possible outcomes of holding stocks.

The point here is that you’re still engaged in the investing process even after you purchase a stock. A Stock Trading Warrior always has a level of alertness about markets, positions, capital appreciation or lack thereof.

If you'd like to read more about when to sell a stock, visit

Selling Stock.

Return from

Holding Stocks back to Stock Trading Systems.

Go to

Online Stock Trading Warrior Home.

Want to Know If Your Stock's In a Trend?